Find all your answers for your Truck Financing:

We have over 50 years of combined experience in the equipment financing business and have heard plenty of questions. Below are some answers to the most commonly asked questions – and if you can’t find your answer, click here for assistance with your specific request. We are here to help.

How does your credit application process work?

A: If you would like to apply for credit with Compass Equipment Finance Inc, please complete the credit application form in Apply for Credit and our sales team will get in touch with you for further details.

Am I eligible for financing?

A: Please fill out the General Enquires form under the Contact Us page and our sales team will get in touch with you shortly.

How long does the approval process take?

A: Depending on the customer’s profile and financial needs, it may take from a few hours to a few days.

What are the interest rates for financing?

A: The interest rates will be based on your needs and the type of financing required. Please contact us to get your custom rates.

How are payments structured?

Payments can be structured to meet the needs of our customers including seasonal and skip payments. In some cases, on approved credit, customers can lease with $0 down payment and first payment will be scheduled on the 1st or 15th of the following month after delivery of the equipment.

How will I know a payment has been completed via Pre-Authorized Payment?

A: Your bank statement will show a debit for your monthly payment amount, made to Compass Equipment Finance Inc. or a similar abbreviation.

What needs to be done if I am making a payment by the Pre-Authorized Payment and I change my bank information?

A: You will be required to provide a copy of a void cheque and sign a new Pre-Authorization Form which can be obtained by calling our Customer Service Department at 1-888-404-CEFI(2334)

How do I obtain a payoff quote on my account?

A: You can obtain payoff quotes by contacting our Customer Service Department at 1-888-404-CEFI(2334). Please have your account number or the last 6 digits of your Vehicle Identification Number (VIN).

When changing jobs, are there any other issues I need to consider regarding my loan or lease with Compass Equipment Finance Inc.?

A: If your truck insurance coverage is obtained through your employer, please notify your insurance agent and instruct them to list Compass Equipment Finance Inc. as loss payee and additional insured for loan contracts and Compass Equipment Finance Inc. as loss payee and additional insured for leases. The agent should then send Compass Equipment Finance Inc. a copy of the insurance certificate via email to inquiries@compassefi.ca, to the attention of the Customer Service Department.

When is my Year-End Interest Statement available and how can I obtain it?

A: Year-End Interest Statements are available anytime and can be obtained by calling our Customer Service department at 1-888-404-CEFI(2334) or email inquiries@compassefi.ca

How can I obtain an amortization schedule of my loan?

A: Amortization schedules are only available to customers through special request. Please contact our Customer Service department at 1-888-404-CEFI(2334) or email inquiries@compassefi.ca to obtain a copy of your schedule.

As an owner-operator, I travel quite a bit and am not always available to handle issues about my account. Is there any way I can assign a third party to manage or discuss my account with Compass Equipment Finance Inc?

A: Yes. Compass Equipment Finance Inc requires you to provide verbal authorization to disclose account information to a designated person. Contact Customer Service to authorize.

How do I get a copy of my ownership?

A: Please call customer service at 1-888-404-CEFI (2334), we can provide a power of attorney for you to request a new ownership at the ministry of transportation.

I’ve recently moved and need to change the registration and title on my equipment to reflect a different province. Can you send me my ownership?

A: Contact Customer Service and we can update your address in our systems as well as the lien registry. We can then provide you with a power of attorney for you to request the new ownership at the ministry of transportation or the SAAQ.

My vehicle is a leased vehicle. Do I need a Power of Attorney from Compass Equipment Finance Inc to change the ownership from one province to another?

A: Yes. Please contact customer service and they will email or fax you a Power of Attorney.

What type of equipment does Compass Equipment Finance Inc. lease?

Compass Equipment Finance Inc. specializes in financing of commercial equipment such as; highway and vocational trucks such as dump trucks, tow trucks, boom trucks, septic pumper trucks and a variety of trailers.

How do I know what my interest rate is on a lease?

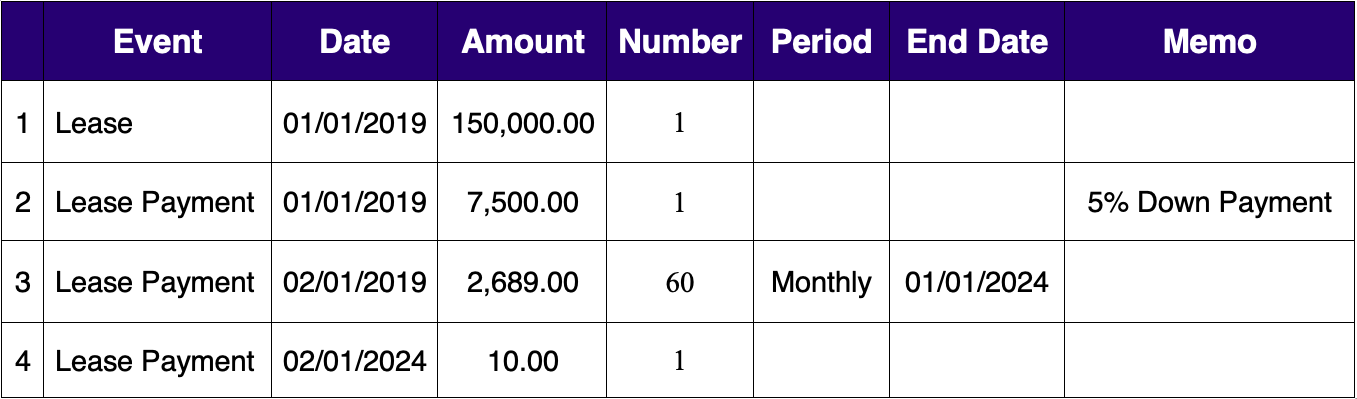

With Compass Equipment Finance Inc., we are transparent with our customers and provide an amortization schedule upon requested. In fact, we can also provide an amortization schedule for our customers on their leased equipment from other lenders. In order to determine your interest rate, you will need to provide your selling price or capitalized cost, the payment schedule and term. (image may be necessary).

Nominal Annual Rate: 5.000%

Cash Flow Data – Leases and Lease Payments

The following method is NOT CORRECT when solving for an interest rate. This method is sometimes used by other lenders and brokers to mislead customers.

| Term | 60 |

|---|---|

| Approved Amount (+tax) | $150,000 |

| Down Payment (+tax) | $7,500 |

| # of Payments and Amount (+tax) | 60 and $2,689.00 |

| Total Interest Cost | $18,850 |

| Avg. Per-Year Interest Cost | $3,770.00 |

| Avg. Cost of Borrowing per Year | 2.65% |

How long can I lease?

Most leases are written for 24, 36, 48, or 60 months, depending if the equipment is new or used. Leases for vocational equipment with a longer lifecycle can be leased with terms of up to 84 months.

What end of lease purchase options are available?

We offer a variety of options from as low as $100 to as high as 50% depending on term. The best option for you can be determined after a brief conversation. We encourage you or your accountant to call our office.

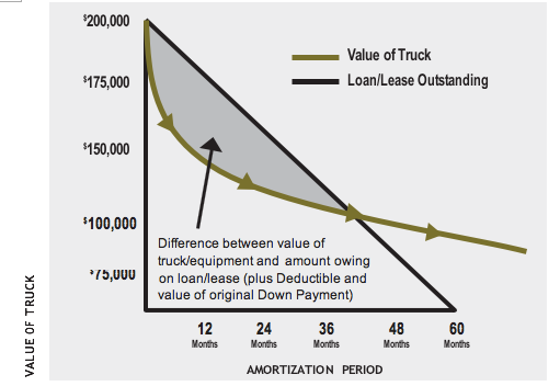

What is GAP Protection and why is it important?

Compass Equipment Finance Inc. offers customers GAP protection. This protection pays the financial “gap” or shortfall between the insurance company settlement and the balance owing to Compass Equipment Finance Inc. up to $100,000. This includes the added bonus of waiving the insurance deductible of up to $5,000 so the customer is truly made whole.

If I put a large down payment is GAP Protection necessary?

Compass Equipment Finance Inc. also offers a Down Payment Protection for customers who want to protect their investments in their equipment. For the first three years after financing your equipment, you may recover up to $30,000 towards the financing of a replacement unit.

Can I change my due date on my lease?

Compass Equipment Finance Inc. offers payment dates of the 1st or the 15th of each month. If you wish to change your due date, please contact our Customer Service Dept to make arrangements. A fee covering the change will apply.

Will you finance GST/HST on my finance contract?

If you wish to finance the GST/HST on a purchase finance contract you may choose to balloon the tax amount in the 4th month. The balloon amount will represent the regular monthly payment plus the GST/HST amount financed on your contract.

In order to be reimbursed by CRA you will require a GST/HST number. Once assigned a number by CRA, you or your accountant can file for a reimbursement claim. This process may take several months to complete so it is imperative to pursue this as quickly as possible.

Can I request payment relief if I have a temporary problem?

Compass Equipment Finance Inc. can offer various payment relief options if you run into a temporary problem and are unable to make a schedule payment. We will require information to support your request. An extension fee and an interest payment may apply. To inquire about the various relief options please contact our Customer Service Dept.

Do I have the option of transferring my lease or loan?

Depending on the circumstance of your request, Compass Equipment Finance Inc. may consider transferring your lease or loan to an individual or entity. We will require that the interested party complete a credit application that you can obtain from our Customer Service Dept.

What are my lease end options if I have a residual value?

Prior to the maturity of your lease, a Compass Equipment Finance Inc. advisor will contact you to review your lease-end options concerning your residual obligation. Your options may include the refinancing of your residual value to an extended lease term to a nominal residual value. To discuss your options please contact our Customer Service Dept.